---

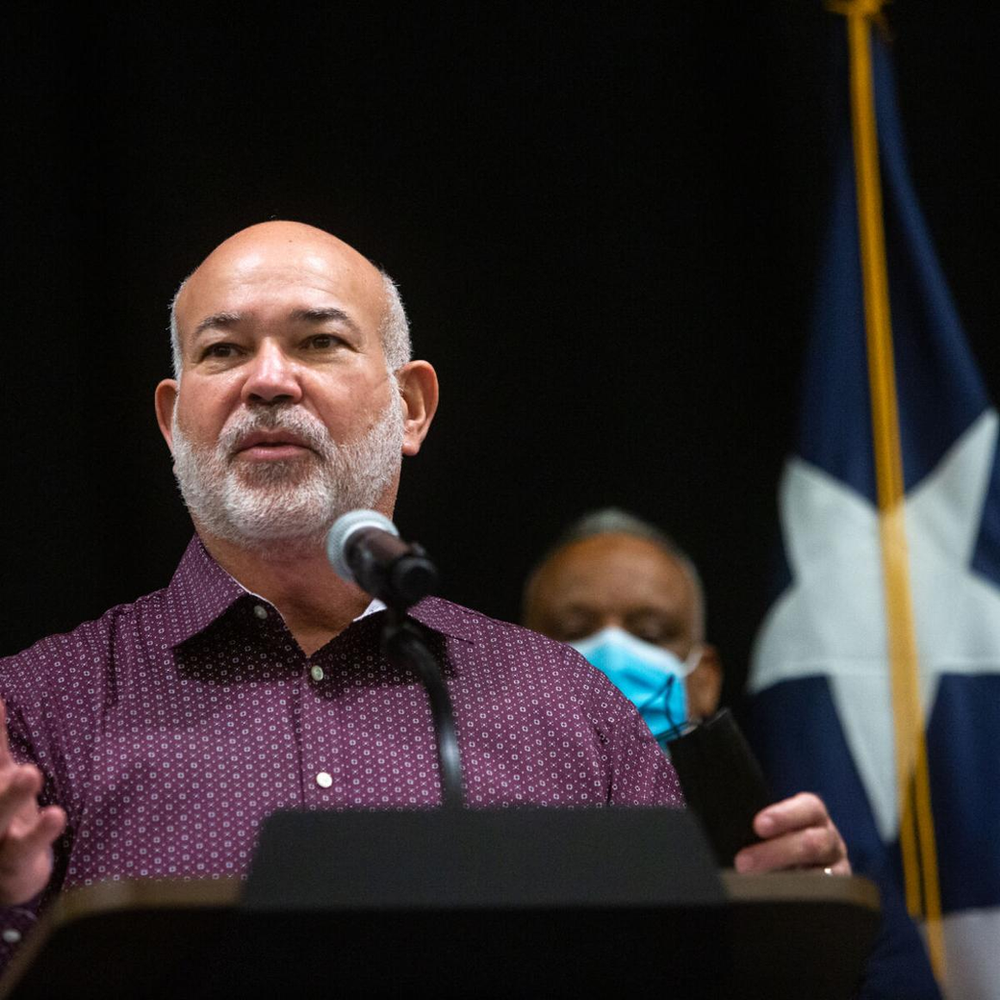

During the weekend, New Progressive Party (NPP) Representative Carlos “Johnny” Méndez Nuñez revealed that his team aims to endorse the initiative proposed by NPP gubernatorial candidate Jenniffer González Colón to abolish the “inventory tax” within the first half of 2025.

This tax is levied on the value of inventories, which includes finished products, partially assembled items, or raw materials. The business community has long advocated for its removal, as it heightens the costs associated with operations. However, many municipalities oppose its abolition due to its significance as a revenue source.

“I believe this matter is vital for the economic progression of Puerto Rico,” remarked the NPP minority leader in the island’s House of Representatives. “For the last two terms of office, I have been championing the removal of the inventory tax, a fixed 9 percent rate, which negatively impacts small and medium-sized vendors as well as consumers. The ramifications of this tax resonate throughout all sectors of the economy and society. That is why we back the proposal put forth by our upcoming governor. We will strive within the House of Representatives to ensure this legislation gains approval within the initial six months of the new majority.”

Méndez commended Bayamón Mayor Ramón Luis Rivera Cruz for also taking steps to address the inventory tax.

Last week, San Juan Mayor Miguel Romero Lugo declared his intention to introduce a city ordinance aimed at eliminating the inventory tax for businesses generating annual sales of up to $500,000.

“We are pleased that the San Juan mayor aligns with our proposal and that of our future governor regarding the inventory tax issue to facilitate its elimination,” stated Méndez. “The phenomenon known as ‘out of stock’ is measurable and materially impacts due to insufficient inventory levels. Prior to Hurricane Irma [in 2017], the out-of-stock inventory rate was at 16; following the hurricanes, it surged to 44 percent. Since the final quarter of 2018, the rate has remained around 23.6 percent, indicating inventories are operating at only three-quarters of their usual capability to satisfy the demands of Puerto Rican consumers,” he added.

González Colón has suggested establishing a committee to assess proposals that would, among other objectives, facilitate the abolition of the inventory tax, categorizing it as a “regressive tax” measure.

Data from the Municipal Revenue Collection Center indicates that the inventory tax contributes between $210 million and $230 million annually to municipal revenues.