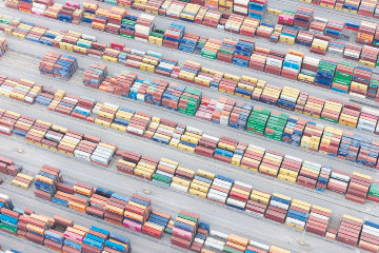

Containers situated at the Port of Georgia, along the Savannah River, on Tuesday, Oct. 1, 2024. Some investors feel reassured by a decisive election outcome and are looking forward to tax reductions and deregulation stemming from a potential second Trump administration. (Adam Kuehl/The New York Times)

By TALMON JOSEPH SMITH

Donald Trump’s electoral triumph sent ripples throughout financial markets. Just two weeks later, speculations concerning the economy’s trajectory and corporate victors or vanquished — referred to as the “Trump trade” on Wall Street — are gaining momentum.

Stock valuations for anticipated beneficiaries have surged: Bank stocks have climbed, as investors expect more relaxed regulations. This trend applies to numerous large corporations aiming to merge or acquire, pursuits that have often faced obstacles or discouragement under President Joe Biden.

The market value of Tesla, led by Trump adviser and campaign supporter Elon Musk, has spiked over 40% since last week’s election. Cryptocurrencies, which Trump has vowed to support more, have also risen, with bitcoin reaching new highs.

Reflecting the president-elect’s commitments to stringent immigration policies, which could boost demand for detention services, shares of private prison companies have also significantly increased.

Expected losers have seen stock prices decline, including smaller green energy companies that thrived under Biden-era tax incentives. A variety of retailers and manufacturers reliant on imported products are also facing challenges due to their vulnerability to tariffs that Trump has proposed.

Overall, the stock market has soared to new heights, eclipsing its previous records from earlier this year.

While a relatively robust economy will welcome the next Trump administration, the president-elect’s policies regarding trade, immigration, monetary policy, and more could yield unpredictable consequences, leading some in Wall Street to feel cautious about the long-term outlook. Additionally, many citizens and civic organizations are anxious, concerned about Trump’s vows to settle scores and disrupt U.S. policies.

Nevertheless, investors and business executives predominantly remain fixated on market fundamentals: growth in earnings.

Earnings growth projections for the next two years, already substantial, are being revised upwards by some analysts following the election. Apart from deregulation, the Trump administration’s intent to reduce corporate taxes is expected to enhance the earnings many companies keep, which could be allocated for expansions or increasing shareholder returns through dividends or buybacks.

“We’ve already got a solid earnings backdrop,” stated Joseph Quinlan, head of market strategy for Merrill and Bank of America Private Bank, “and it just improved.”

However, the market surge is not solely influenced by political factors; it also reflects a sense of relief among investors that the election results are indisputable, avoiding prolonged contention.

The anticipated scenario of “civil strife or major urban violence” didn’t come to fruition, said Adam Parker, founder of Trivariate Research, which advises significant corporations. “And we immediately knew who the winner was — that brings relief, certainty.”

The possibility of increased tariffs casts a shadow over earnings projections.

A staggering amount of uncertainty persists with Trump’s return to the White House still over two months away.

Industry organizations and a majority of economists have been cautioning that widespread tariffs could potentially reignite consumer inflation, harm corporate earnings, and provoke a destabilizing global trade war.

“Retailers are heavily reliant on imported products and manufacturing components, allowing them to provide a diverse array of items at reasonable prices,” Jonathan Gold, vice president of supply chain and customs policy at the National Retail Federation, mentioned in a statement prior to the election. “A tariff is a tax incurred by the U.S. importer, not a foreign country or exporter. Ultimately, this tax affects consumers through heightened prices.”

Tariffs could “speed up investment in bringing jobs back from abroad,” said Samuel Rines, an economist and macro strategist at WisdomTree, a financial enterprise. Simultaneously, Rines noted, “we are uncertain about what will be enforced, and thus what is being factored in is the least adverse scenario.”

That scenario envisions “tactical” tariffs that aim to secure more favorable trading conditions from international counterparts. “I wouldn’t say there’s any guarantee that it will be tactical, but the market presumption is that it will be,” he added.

The introduction of new tariffs — which can occur for an extended period without needing congressional consent — could heighten expenses and compress profit margins. Generally, companies can choose their approach: elevate prices to maintain margins as they absorb import taxes, keep prices steady to prevent losing consumer sales, or manufacture products in countries with lower or no tariffs.

That last option can require time, though certain companies are already making moves, like shoemaker Steven Madden, which informed shareholders last week that it plans to reduce nearly half of its production in China within the next year to prevent tariffs from affecting revenues. However, it remains uncertain if this production will be relocated to the United States.

Some companies are already signaling intentions to raise prices.

“Should tariffs be implemented, we will pass those costs to the consumer,” Philip Daniele, CEO of vehicle parts supplier AutoZone, stated during a recent analyst call — adding that the company would increase prices “in advance of” the initiation of tariffs, rather than waiting.

Businesses are apprehensive about retaliation and the Federal Reserve’s actions.

Many corporate leaders might welcome the departure of Biden administration regulators. However, Brent Donnelly, president of Spectra Markets, a market research firm, highlights that executives might be trading one challenge for another: facing the ire of Trump, who has publicly criticized those he perceives as adversaries of his agenda.

“There’s considerable apprehension in corporate America about being unable to voice anything critical regarding the dear leader,” Donnelly remarked.

Publicly opposing Trump poses “a headline risk” that could negatively impact a company’s stock price, he explained, adding, “All it takes is one tweet.”

The president-elect has also suggested he should have greater influence over interest rates. Current and former Federal Reserve officials assert that this undermines the independence of the central bank, which is mandated to establish rates to steer the economy toward maximum employment and long-term price stability.

Fed Chair Jerome Powell defended the institution in a news briefing last week, responding resolutely with a “no” when questioned about stepping down if asked by Trump.

The multitrillion-dollar bond market — which usually reacts negatively to indications that inflation might rise or that the Fed might not be decisive in curbing it — calmed after Powell’s statements but continues to exhibit unease.